You’re looking for a new broker and wondering if CedarFX is worth your time. In this article, we’ll try to share everything you need to know to decide if they’re the right choice for you. From regulation and security to available markets and fees, we’ve done the research so you can trade with confidence.

An Overview of CedarFX

CedarFX is a reputable online forex and cryptocurrency broker known for its eco-friendly approach to trading. Founded in 2020, it stands out for its commitment to sustainability. It offers clients the option to open eco-trading accounts denominated in cedar trees rather than traditional currencies.

This platform provides a wide range of trading instruments, including forex, cryptocurrencies, commodities, and stocks, with competitive spreads and leverage options. Their user-friendly platform and educational resources make it suitable for both beginners and experienced traders.

For traders who prioritize environmental responsibility, CedarFX’s dedication to green trading and its philanthropic initiatives make it a compelling choice in the online trading industry.

Regulation and Security of CedarFX

You’ll want to know your funds and personal information are secure with any broker you choose. CedarFX is regulated by multiple top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

CedarFX keeps client funds in segregated accounts at trusted banks and uses advanced SSL technology to encrypt all sensitive data. Two-factor authentication, firewalls, and other security measures help prevent unauthorized account access.

The regulation also means CedarFX adheres to strict standards around transparency, fair trading, and avoiding conflicts of interest. They provide clear terms and conditions, do not trade against clients or take the other side of your trades, and are upfront about risks.

If you ever run into issues, regulators require CedarFX to have procedures in place for complaints and dispute resolution. You can feel confident your concerns will be properly addressed by their compliance department.

While risks are inherent to any investment, CedarFX checks all the boxes for a secure and well-regulated broker. You can open an account knowing your money and information are in capable hands, with all the oversight and protection regulation provides.

Overall, CedarFX is a legit and trustworthy broker, not a scam. Their regulation, security measures, and compliance with ethical standards provide reassurance on that front.

What You Can Trade on CedarFX?

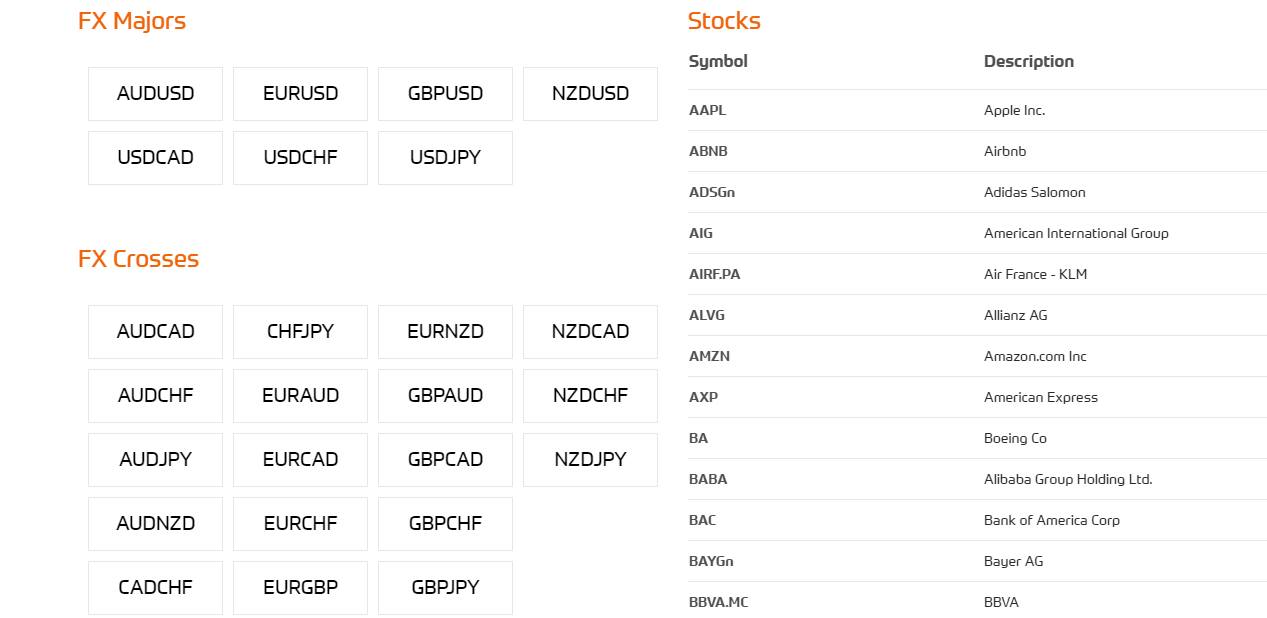

CedarFX offers a wide range of tradable assets to suit any trader’s needs. You have access to over 200+ assets across major markets. This includes:

- Forex: Trade over 50 currency pairs, from major pairs like EUR/USD to exotic pairs. Spreads are tight and leverage up to 1:500 is available.

- Stocks: Trade shares of major companies like Apple, Tesla and Amazon. Over 4,000 stocks are offered from global exchanges.

- Commodities: Trade commodities such as gold, silver, oil and natural gas. Hard and soft commodities are available.

- Indices: Trade stock indices from around the world, including S&P 500, FTSE 100, Nikkei 225 and more. Go long or short on indices.

- ETFs: Trade popular ETFs that track commodities, bonds, sectors, and indices. Over 200 ETFs are offered.

- Bonds: Trade government and corporate bonds with varying maturities. Bonds provide steady income streams with lower volatility.

Fees of CedarFX

To trade on CedarFX, you’ll need to fund your account. The minimum initial deposit is $250. CedarFX offers several convenient ways to deposit funds:

- Debit/Credit Card: Deposit instantly using your Visa or Mastercard. Processing fees may apply.

- Wire Transfer: Transfer money directly from your bank account. Typically takes 1-3 business days to process but no fees.

- E-Wallets: Use popular e-wallets like Skrill, Neteller, or PayPal to deposit. Funds are usually available instantly with low or no fees.

Withdrawals are processed similarly but do allow 3-5 business days for the funds to appear in your account. There are no withdrawal fees for wire transfers or e-wallets. Debit/credit card withdrawals do have a small fee of 1-3% of the amount.

The fees on CedarFX are fairly standard for the industry. They do offer tight spreads, currently averaging 0.6 pips on EUR/USD and a commission of $3 per standard lot round turn. Swap rates, which are the fees charged for holding positions overnight, are also competitive.

While the fees won’t make or break you, the lack of hidden charges and transparency in CedarFX’s pricing model adds to its credibility and reputation as a trusted broker.

When evaluating a broker, fees are an important factor, but regulation, security, and customer service should also weigh heavily in your decision. On all these counts, CedarFX scores very well, which is why we give them a recommendation for both new and experienced traders.

CedarFX Customer Support

CedarFX offers customer support 24 hours a day, 5 days a week via live chat, email, and phone. They aim to respond to all customer queries within 24 hours.

Live Chat

The live chat feature on the CedarFX website and mobile app allows you to instantly connect with a customer service representative. Just click the chat bubble in the bottom right corner of your screen and start typing your question.

Live chat is available 24/5 and support reps typically respond within a few minutes. This is a great option if you need an immediate answer to a simple question.

For more complex issues or feedback, emailing support@cedarfx.com is your best bet. The support team monitors this email around the clock and aims to reply to all emails within one business day. Be sure to provide as much detail as possible about your question or concern in your initial email. The support reps may ask for additional information to fully assist you.

Phone

If you prefer to speak to someone directly, CedarFX support can also be reached by phone at +44 20 8123 7019. Phone support is available 24 hours a day, 5 days a week.

There may be short wait times during peak hours. Calling is a good choice if your issue requires an in-depth discussion or explanation.

CedarFX takes customer service and support seriously. Their team is knowledgeable, professional, and committed to providing the best experience for all clients. Don’t hesitate to contact them with any questions about their platform, tools, resources, or your own account. They are there to help you succeed in your trading.

Is CedarFX Legit or Scam?

So, is CedarFX legit or a scam? After reviewing all aspects of this broker in detail, CedarFX can be considered a legitimate broker. Here are a few reasons why:

Regulation and Security

CedarFX is regulated by the Vanuatu Financial Services Commission (VFSC), which helps ensure they follow best practices. They also use advanced SSL encryption to keep your data and funds secure.

Trading Conditions

CedarFX offers competitive spreads, no commissions, and high leverage up to 1:400 for forex trading. You have access to over 50 currency pairs, commodities, stocks, and indices. The MetaTrader 4 platform is easy to use but still provides advanced tools for analysis.

Fees

To open an account, the minimum deposit is $250. CedarFX doesn’t charge any commissions. They make money through the spread, which is the difference between the buy and sell price. Withdrawals are free and processed within 1-2 business days. Multiple payment methods are accepted including e-wallets.

Customer Support

CedarFX provides 24/5 customer service via phone, email, and live chat. Support is available in multiple languages. From our experience, the support team was very responsive and helpful.

Pros and Cons of CedarFX

Pros of CedarFX

- Regulated and secure. CedarFX is regulated by the Vanuatu Financial Services Commission and keeps your funds in segregated accounts, so your money is safe.

- Wide range of assets. You can trade forex, commodities, stocks, indices, and cryptocurrencies on CedarFX. There are over 250 trading instruments to choose from.

- Low fees. CedarFX has no commissions and tight spreads. The minimum deposit is only $250 and you can fund your account with credit/debit cards, wire transfers, and e-wallets like Skrill and Neteller. Withdrawals are free and processed within 1-2 days.

- Great customer support. CedarFX provides 24/5 support via live chat, email, and phone. Their support team is helpful, knowledgeable, and quick to respond.

Cons of CedarFX

- Only one account type. CedarFX only offers one standard account type. They don’t offer accounts tailored to different trader levels.

- Limited research tools. The platform is easy to use but lacks advanced charting tools and indicators. The research materials are fairly basic.

Final Thought

So there you have it, a complete guide to the CedarFX brokerage. They offer a wide range of trading instruments, competitive fees, and a secure trading environment.

While they are still relatively new, CedarFX seems to be a legitimate broker that can meet the needs of most traders. If you’re looking for an all-in-one broker with excellent customer service, CedarFX should be at the top of your list.

2 Responses