Do you have an interest in getting into trading but aren’t sure where to start? Don’t worry, we’re here to help you. We’re going to give you the full details on First Prudential Markets, one of the top online brokers for beginner traders.

Whether you’re looking to dip your toe in the stock market or dive headfirst into forex trading, First Prudential Markets has everything for you. Keep reading this article and learn more about this platform.

Overview of First Prudential Markets

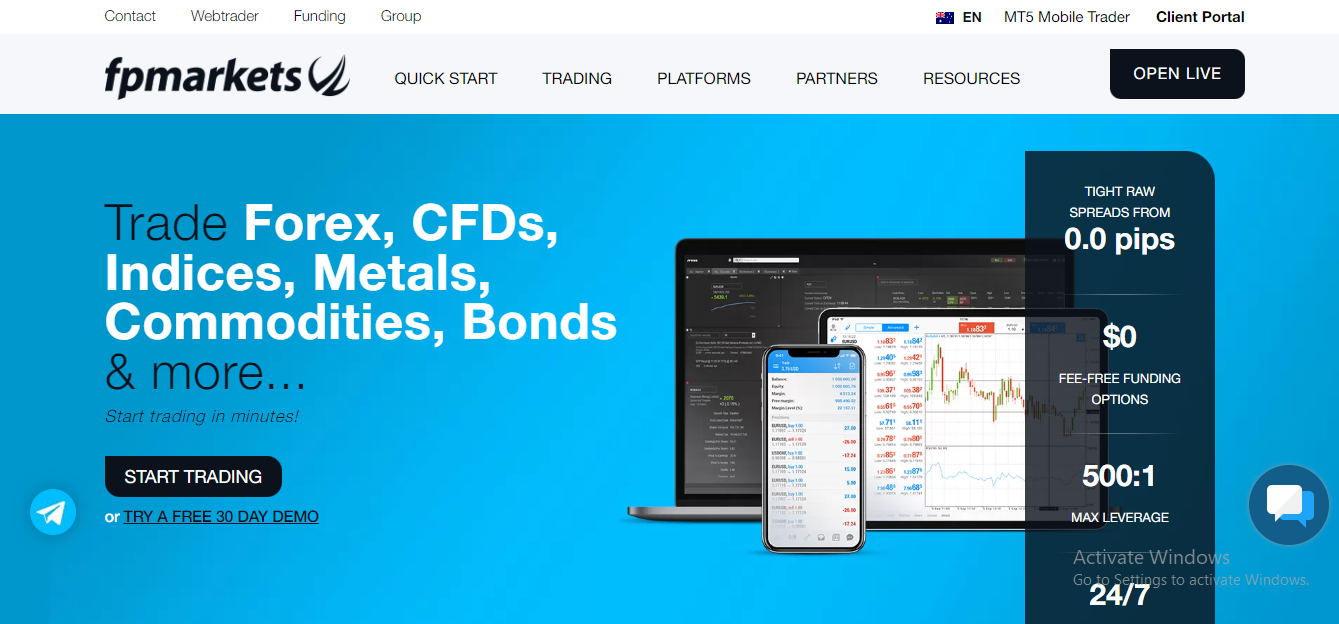

An overview of First Prudential Markets (FP Markets) shows it is a reputable forex and CFD broker. FP Markets has been operating since 2005 and is regulated by several top-tier financial authorities, including the Australian Securities and Investments Commission (ASIC).

Tradable Products

FP Markets offers forex trading in over 60 currency pairs as well as CFDs on indices, commodities, stocks, and metals.

![]()

Some of the major instruments you can trade include:

- Major, minor, and exotic currency pairs

- Spot metals like gold and silver

- Crude oil, natural gas, and soft commodities

- Global stock indices such as S&P 500, FTSE 100 and Nikkei 225

- Shares of major companies including Apple, Tesla and Alibaba

Trading Platforms

FP Markets provides the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. These platforms are available as desktop applications as well as mobile apps for iPhone and Android. You can also use MT4/MT5 web versions to trade directly from your web browser.

In summary, FP Markets is a reputable and well-regulated broker that provides competitive trading conditions, a wide range of financial products to trade as well as robust and user-friendly trading platforms. With 15 years of experience, FP Markets is a trusted broker and worth considering if you’re looking for a new forex or CFD broker.

Products and Services Offered by First Prudential Markets

First Prudential Markets offers a wide range of investment products and services for both retail and institutional investors. For retail investors, they provide stocks, bonds, ETFs, options, futures, forex, and CFD trading across major markets. They offer competitive commissions and spreads, as well as educational resources to help you become a better trader.

For institutional investors, First Prudential Markets provides prime brokerage services, algorithmic trading, and direct market access for high-volume traders. They are connected to all major exchanges and dark pools, with fast order execution and clearing. Their team can help set up, optimize, and manage automated trading systems and algorithms.

First Prudential Markets also offers managed investment accounts for those looking for professional guidance. Their portfolio managers create customized portfolios tailored to your financial goals and risk tolerance. They monitor markets daily and rebalance as needed to maximize returns while minimizing risk.

Whether you’re an active retail trader, institutional investor, or looking for managed accounts, First Prudential Markets has a solution. Their diverse products, competitive pricing, educational resources, and professional support provide investors with the tools and guidance to meet their financial objectives. Opening an account is easy and they offer 24/5 customer service to help you get started. Why not give them a try?

Why Trade With First Prudential Markets(Fp Markets)?

Why should you trade with First Prudential Markets? There are several reasons why First Prudential Markets stands out from other brokers.

![]()

They offer a user-friendly trading platform with powerful tools for analysis. Their platform is intuitive and easy to navigate, even for beginners. However, it also provides advanced charting features, indicators, and drawing tools for more experienced traders. This means you get the best of both worlds – an easy onboarding but with room to grow into more advanced trading strategies.

Also, First Prudential Markets has competitive fees. They charge no commission on stock, ETF, and options trades. Forex trades have a low spread. The only fee is a flat $5 charge for broker-assisted trades made over the phone. This can add up to major savings compared to other brokers that charge $5 or more per trade.

They provide great customer support and offer 24/7 phone support as well as email and live chat. The support staff are knowledgeable, friendly, and quick to respond. As a trader, it’s reassuring to know you can get help right away if you have any questions or run into issues.

Final Thought

First Prudential Markets seems to be a reputable and trustworthy broker offering competitive fees and a wide range of investment options to suit any trader’s needs. While there are certainly cheaper alternatives out there, you really do get what you pay for.

The combination of excellent customer service, innovative tools, and rock-solid security provides peace of mind that your money is in good hands. If you’ve made it this far through the review, you’re clearly serious about finding the right broker.

2 Responses