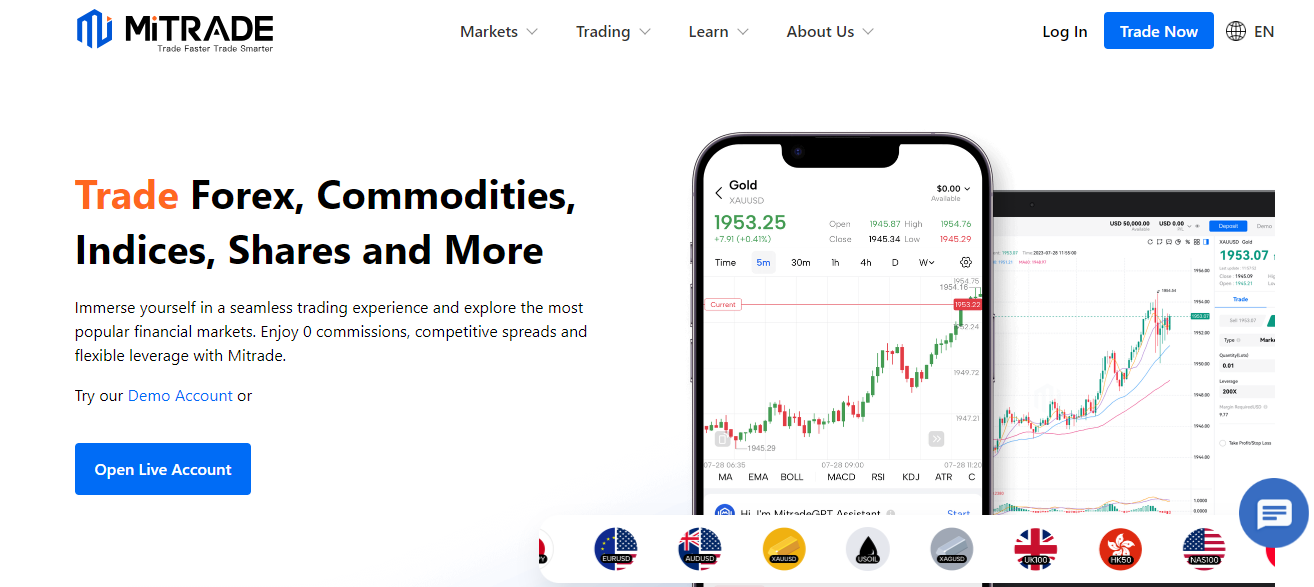

Mitrade is a prominent online trading platform that has been gaining attention in the world of financial markets. It offers a wide range of trading instruments, including Forex, cryptocurrencies, commodities, and indices, making it a versatile choice for both novice and experienced traders. In this article, we’ll try to share everything about this Mitrade so that you know whether it is good for you or not. So, let’s dig into this article.

Overview of Mitrade

Mitrade is a popular forex and CFD broker founded in Australia. As an Australian broker, Mitrade is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a safe trading environment for traders.

It allows you to trade over 180+ instruments including forex, commodities, indices, and shares CFDs. You can open an account and start trading with a minimum deposit of just $50.

Mitrade offers competitive spreads and commissions, with no hidden fees. You can fund your account using multiple payment methods such as bank transfer, credit/debit cards, PayPal, Neteller, and Skrill. Withdrawals are also fast and free of charge.

Regulation and Security on the Mitrade Platform

Mitrade is regulated by several top-tier authorities, so you can trade easily knowing your funds and data are secure.

The Australian Securities and Investments Commission (ASIC) regulates Mitrade’s Australian entity. They enforce strict rules around client money segregation and oversight.

![]()

In Europe, the Cyprus Securities and Exchange Commission (CySEC) regulates Mitrade’s EU entity. CySEC requires regulated brokers to follow guidelines protecting traders and their money.

Mitrade Global also has a Vanuatu license, overseen by the Vanuatu Financial Services Commission (VFSC). Though a small nation, VFSC holds brokers to high standards, ensuring fair dealing and the safety of funds.

With licenses from these respected regulators, you can feel confident your money and information are in good hands at Mitrade. Top-tier oversight means top-tier security.

What You Can Trade on Mitrade?

![]()

You can trade a variety of assets on Mitrade, including:

Forex – Mitrade offers access to over 50 currency pairs, from major pairs like EUR/USD to exotics. Trade whenever the markets are open with competitive spreads and no commissions.

Indices – Mitrade offers 12 major stock indices to trade, including S&P 500, NASDAQ, FTSE 100 and Nikkei 225. Go long or short on index movements without actually owning the underlying stocks.

Commodities – Trade gold, silver, and oil without taking physical delivery. Speculate on price movements of these popular commodities.

Cryptos – Mitrade offers 5 major cryptocurrencies: Bitcoin, Ethereum, Litecoin, Ripple and Bitcoin Cash. Trade crypto 24/7 with up to 100x leverage.

Stocks – This platform provides access to over 200 popular US and Hong Kong stocks, from tech giants to eCommerce to biotech companies. Buy and sell shares with competitive commission rates.

Fees of Mitrade

Mitrade offers commission-free trading, so you won’t pay any fees per trade. However, the broker profits from the spread, which is the difference between the buy and sell price of an asset. The spreads are fairly competitive though, starting at 0.6 pips for EUR/USD.

Depositing money is free of charge for most payment methods like bank wire, credit/debit cards, and e-wallets such as Skrill or Neteller. The minimum deposit amount depends on the account type but starts at just $50 for a Standard account.

![]()

Withdrawing your funds is also free of charge, but Mitrade charges a small fee for certain payment methods. Bank wire withdrawals have a fixed fee of $30, while credit/debit card and e-wallet withdrawals are free. The processing time for withdrawals is usually 1-3 business days.

Overall, Mitrade’s fee structure is very transparent and competitive. The broker makes its money from the spreads while keeping deposits and withdrawals free for the most part. The low minimum deposit amount also makes Mitrade accessible to all types of traders.

Evaluating Mitrade’s Customer Support

Mitrade’s customer support is available 24/5 via live chat, email, and phone. Their support staff are friendly, knowledgeable, and quick to respond. Whether you have a basic question about funding your account or a more complex query about Mitrade’s trading platform, you can expect a helpful response within a few minutes during business hours.

Top Mitrade Alternatives for Traders

If Mitrade doesn’t quite suit your needs, check out these two alternative brokers. CMC Markets is a reputable broker regulated in multiple countries. They offer competitive spreads and over 10,000 tradable instruments across forex, indices, stocks, commodities, treasuries, and cryptocurrencies.

CMC Markets has been around since 1989, so they have loads of experience. They also have a popular trading platform and useful trading tools for all skill levels.

AvaTrade is another trusted broker with regulation in 6 continents. They provide access to more than 250 financial instruments including forex, stocks, bonds, ETFs, indices, and commodities.

It is particularly suitable for beginners because their platforms are very intuitive and they offer lots of educational resources. You can start trading with as little as $100 and AvaTrade does not charge any commissions on trades.

Is Mitrade a Legit and Trustworthy Broker?

Mitrade is a legit and trustworthy broker. They are regulated in Australia by the Australian Securities and Investments Commission (ASIC), which helps ensure they follow strict rules to protect traders. Mitrade also segregates client funds from their own in separate accounts to keep your money safe.

With competitive spreads, over 200 tradable instruments, and solid regulation, Mitrade checks the boxes for a trustworthy broker. Their customer service also gets good reviews for being responsive and helpful. Overall, Mitrade appears to be a legit broker committed to serving its clients well and helping you become a successful trader.

Pros and Cons of Trading With Mitrade

Mitrade offers some attractive benefits for traders, but also some downsides to consider:

Pros:

- Low fees. Mitrade has low spreads, no commissions, and a low $20 minimum deposit.

- Easy to use. The Mitrade website and mobile apps are simple to navigate.

- Many assets. You can trade forex, commodities, indices, stocks, and cryptocurrencies.

Cons:

- Limited education. Mitrade’s education resources are basic. You’ll need to supplement.

- No MT4/5. Mitrade only offers its own web and mobile platforms, not the popular MT4/5.

Final Thought

While no broker is perfect, Mitrade seems to tick a lot of boxes with competitive fees, a solid range of assets, and strong security. The next step is up to you – open a demo account to test the waters, then go live when you’re ready.

Whatever you decide, make sure to do your own research to find a broker that suits your unique situation. The world of trading has a lot of opportunities, so take your time to find what works for you.