So you’re interested in Admiral Markets and wondering whether they’re the right broker for you. As one of the biggest names in the forex and CFD trading space, Admiral Markets offers a lot to like.

But are they really as good as they seem? In this full Admiral Markets review, we’ll give you the unvarnished truth about everything from their regulation and security to the assets you can trade, fees, customer support, and more. So, let’s dig into this article.

An Overview of Admiral Markets

![]()

Admiral Markets is a reputable forex and CFD broker that has been serving traders worldwide since 2001. They are regulated in several major jurisdictions, including the UK, Australia, and Estonia. This means your funds and personal information will be kept secure.

You’ll find an impressive range of instruments to trade on Admiral Markets’ platforms. They offer forex pairs, stocks, indices, commodities, bonds, cryptocurrencies, and ETFs. No matter what you want to trade, Admiral Markets likely has it.

Admiral Markets keeps their fees affordable and transparent. The minimum deposit is just $1 to open a live account. You can fund your account and withdraw money via bank wire, credit/debit cards, Skrill, Neteller, and more – all with no fees. Spreads and commissions are also competitive.

Regulation and Security of Admiral Markets

If security and regulation are important to you, Admiral Markets should put your mind at ease. Admiral Markets is regulated in multiple countries, including:

![]()

- The Australian Securities and Investments Commission (ASIC)

- The Financial Conduct Authority (FCA) in the UK

- The Cyprus Securities and Exchange Commission (CySEC)

Funds deposited with Admiral Markets are held in segregated bank accounts for safety. They also participate in investor compensation schemes like the Financial Services Compensation Scheme (FSCS) in the UK that protect your funds up to £85,000.

What You Can Trade on Admiral Markets?

Admiral Markets offers a wide range of instruments for traders to take advantage of. You’ll find all the major markets and asset classes available on their platforms.

![]()

Forex

Admiral Markets is best known as a forex broker, offering over 80 currency pairs including major, minor, and exotic pairs. You can trade spot forex, forwards, or forex options.

CFDs

Contract for differences or CFDs allows you to trade on the price movement of stocks, indices, commodities, bonds, ETFs, and even cryptocurrencies. Admiral Markets offers CFDs on thousands of instruments across global markets.

Stocks

Access over 4,500 stocks from major global exchanges including the New York Stock Exchange, London Stock Exchange, and Hong Kong Stock Exchange. Trade the shares of Apple, Amazon, Facebook, and other leading companies.

Indices

Speculate on the movement of major stock indices like the S&P 500, FTSE 100 and DAX 30. Admiral Markets offers CFDs and spreads betting on indices from the US, Europe, UK, China, and other markets.

Commodities

Trade soft commodities like corn and wheat, precious metals such as gold and silver, or energy commodities like crude oil and natural gas. Over 20 commodities are available as CFDs.

Fees of Admiral Markets

When it comes to fees, Admiral Markets keeps things straightforward. You’ll encounter the usual forex broker costs, but Admiral Markets aims to provide transparent pricing and competitive rates.

Minimum Deposit

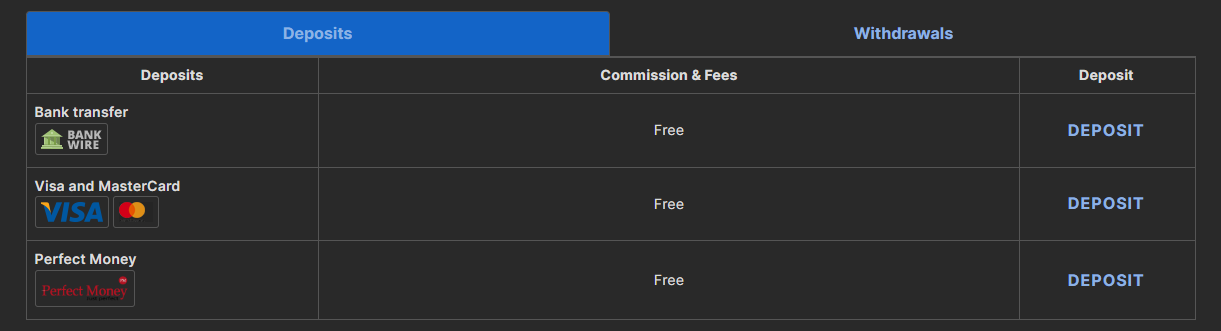

To open a live trading account, Admiral Markets requires a minimum deposit of $100. This is in line with most forex brokers and allows you to start trading with a modest amount of capital. They accept deposits via bank wire transfer, and credit/debit cards like Visa and Mastercard, Skrill, Neteller, and more.

Spreads and Commissions

Admiral Markets offers tight spreads, starting at 0.0 pips for major currency pairs like EUR/USD. For most currency pairs, you can expect spreads of 0.5 to 1.5 pips. Admiral Markets does not charge any commissions on forex trades. The spread is how they make money.

Swap Rates

For positions held overnight, Admiral Markets charges a swap fee. Swap rates can be positive or negative depending on the currency pair and whether your position is long or short. Swap rates are calculated based on prevailing market rates.

Withdrawal Fees

![]()

You can withdraw funds from your Admiral Markets account at any time without penalty. They do not charge for wire transfers, but the receiving bank may charge a small fee. Electronic withdrawals via Skrill, Neteller, etc. are free of charge. Withdrawals are processed within 1 to 3 business days.

Admiral Markets Customer Support

Admiral Markets offers customer support 24 hours a day, 5 days a week via live chat, email, and telephone. Their support team is knowledgeable and responsive, aiming to resolve any issues as quickly as possible.

Live Chat

The live chat feature on Admiral Markets’ website and trading platforms allows you to instant message support agents. Wait times are typically under 2 minutes to connect with an agent. The agents we chatted with were courteous, answered our questions accurately, and provided helpful information.

You can also email Admiral Markets at support@admiralmarkets.com. In our experience, they respond within 4 business hours. The email support agents provided detailed written responses to our questions. This can be a good option if you have a complex issue or need to provide screenshots.

Phone

Admiral Markets offers dedicated phone support lines for their major markets. For example, customers in the UK can call +44 20 3670 9945. Phone support is available 24/5. When we called, there was an automated greeting and holding music while waiting just a few minutes to speak to a live agent. The agent was professional, and knowledgeable and resolved our questions over the phone.

Is Admiral Markets Legit or Scam?

So, is Admiral Markets legit or a scam? Based on our extensive research, Admiral Markets is a reputable and regulated broker, not a scam. Here are a few reasons why:

Admiral Markets is regulated by top-tier financial authorities like the UK’s Financial Conduct Authority (FCA) and Australia’s ASIC. These regulators enforce strict rules around capital requirements, client fund segregation, and transparency. Admiral Markets adheres to all of these rules to maintain their licenses.

It has been in business since 2001 and has over 18 years of experience as a broker. They have served hundreds of thousands of clients worldwide and currently have over 200 employees across offices in 13 countries. This longevity and size suggests Admiral Markets is a well-established, legitimate company.

Pros and Cons of Admiral Markets

Pros:

Regulated and secure: Admiral Markets is regulated by top-tier authorities like the FCA, ensuring your funds and data are safe.

Low fees: Admiral Markets has very competitive fees, including no commissions on stock CFDs and low spreads on forex and crypto. The minimum deposit is also only $100.

Great for beginners: Admiral Markets’ platforms are easy to use, and they offer resources to help you learn. You can start with a demo account to practice before going live.

Cons:

Higher leverage risks: While leverage up to 1:500 is offered, this also means you can lose money fast if the market moves against you. Higher leverage is riskier, especially for new traders.

Final Thought

Admiral Markets offers a solid choice for traders looking for a reputable broker. You get access to a wide range of markets and assets to trade, competitive fees, and 24/7 customer support.

The platform is intuitive and packed with advanced tools and features to help you analyze the markets and place trades. Regulation by top-tier authorities gives you peace of mind that your funds and data are secure.

While no broker is perfect, Admiral Markets checks most of the important boxes for a trustworthy broker. If you’re ready to start trading, you can open an account on their website and fund it to get started right away.

2 Responses