You’re curious to learn more about JustMarkets, the social trading platform that’s been gaining a lot of buzz recently. Before you dive in and start connecting with expert traders, you want to know exactly what you’re getting into.

This full review of JustMarkets is going to give you the inside scoop so you can decide if it’s the right place for you to invest your time and money. Keep reading to get all the details on what JustMarkets really has to offer.

An Overview of JustMarkets

![]()

When it comes to online brokers, JustMarkets is a popular choice for many traders. JustMarkets is regulated by top-tier authorities like the UK’s FCA and Australia’s ASIC. This means your funds and data are kept secure. JustMarkets also participates in the Financial Services Compensation Scheme, insuring your funds up to £50,000.

It allows you to trade CFDs, forex, stocks, indices, commodities, cryptocurrencies, and ETFs, so there’s a lot of variety. They offer over 10,000+ tradable instruments, competitive spreads, and leverage up to 1:500 for professional clients.

JustMarkets provides customer service 24/5 via live chat, email, and phone. Support is available in multiple languages. The site also has a lot of educational resources to help you become a better trader. It is a reputable, licensed, and award-winning broker. They’ve been serving traders since 2010 and are used by over 300,000+ clients worldwide.

Regulation and Security of JustMarkets

When it comes to regulation and security, JustMarkets ticks all the boxes. As an EU broker, JustMarkets is regulated by the Cyprus Securities and Exchange Commission (CySEC), which enforces strict rules around client funds, transparency, and ethical practices.

![]()

It uses advanced encryption technology and two-factor authentication to keep your information and funds secure. They do not share or sell your personal data to third parties. Client funds are also held in segregated accounts at top European banks.

With solid regulation, multiple funding choices, and strong security protocols in place, you can feel confident opening an account with JustMarkets. While all trading carries risk, you’ll have peace of mind knowing your information and money are in good hands. Focus on honing your strategy and finding the markets that suit you best. Let JustMarkets handle the rest.

What you Can Trade on JustMarkets

When you open an account with JustMarkets, you’ll have access to trade a variety of assets. They offer over 200 tradable instruments across five asset classes:

![]()

Forex

Trade over 45 major, minor, and exotic currency pairs with tight spreads and no commissions. JustMarkets is great for new forex traders with its easy-to-use platform and educational resources.

Stocks

Access over 3,000 stocks from major global exchanges including the NYSE and NASDAQ. Whether you want to invest in tech companies, blue chips, or small caps, JustMarkets has you covered.

Indices

Trade stock market indices from around the world that track the performance of major exchanges. Options include the S&P 500, FTSE 100, Nikkei 225 and more.

Commodities

Diversify your portfolio by trading precious metals like gold and silver, energies such as oil and natural gas, and agricultural goods including coffee, corn, and wheat.

Cryptocurrencies

JustMarkets allows you to speculate on the price of major cryptocurrencies including Bitcoin, Ethereum, Litecoin, and Ripple. Cryptos are a volatile asset class, so only invest money that you can afford to lose.

Fees of JustMarkets

When it comes to fees, JustMarkets keeps things straightforward. As a market maker, they aim to make profits through the bid-ask spread, so most of their services are offered commission-free.

Minimum Deposit

To open a live trading account, JustMarkets requires a minimum initial deposit of $100. This is in line with most other brokers and allows you to start trading with a small investment.

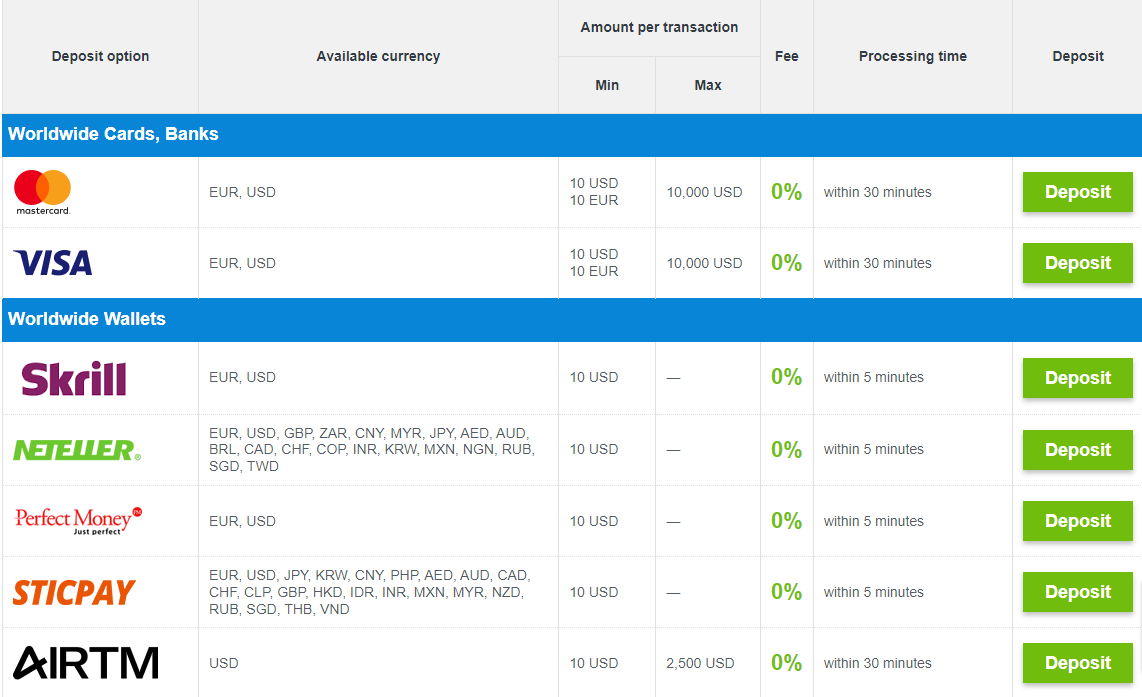

Payment Methods

JustMarkets accepts deposits and withdrawals through credit/debit cards (Visa, Mastercard), bank wire transfers, and e-wallets (Skrill, Neteller). These payment methods are convenient and allow for fast processing times. Wire transfers typically take 3 to 5 business days, while e-wallet and card transactions are usually complete within 1 business day.

Withdrawals

![]()

Withdrawals from JustMarkets are also generally processed promptly within 1 to 3 business days. There are no fees charged for withdrawals, regardless of the method used. The minimum withdrawal amount is $10. As with all brokers, JustMarkets will require verification of your identity and account ownership before releasing funds. This helps to ensure security and prevent fraud.

JustMarkets Customer Support

JustMarkets provides customer support 24 hours a day, 5 days a week via live chat, email, and phone. Their support team is knowledgeable and friendly, aiming to respond to all inquiries within a few hours.

Live Chat

The live chat feature on JustMarkets’ website and mobile app allows you to instantly connect with a support agent. Wait times are usually under a minute, even during the busiest market hours. The agents can walk you through the steps to fund your account, place a trade, or answer any questions about the platform.

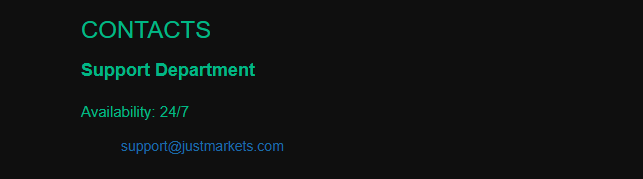

Email Support

If you have a more complex issue or question, email support is available at support@justmarkets.com. Provide as much detail as possible about your question or concern and a support representative will respond, typically within 3 to 6 hours during regular business hours. The email support team can also handle account verification requests and password reset inquiries.

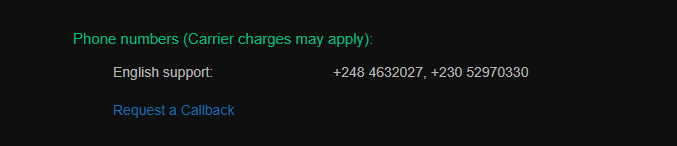

Phone Support

For urgent matters, you can call JustMarkets’ support hotline for live phone support 24/5. Wait times to speak to an agent are under 5 minutes. The phone support team has the ability to handle account security issues, large withdrawal requests, and other time-sensitive issues that require personal assistance.

Is JustMarkets Legit or Scam

So, is JustMarkets legit or a scam? After reviewing all aspects of this broker, we can confidently say JustMarkets is a legitimate broker. Here are a few reasons why:

Regulation

JustMarkets is regulated by top-tier regulators like the UK’s Financial Conduct Authority, the Australian Securities and Investments Commission, and the Cyprus Securities and Exchange Commission. These regulators enforce strict rules around capital requirements,

client fund segregation, and transparent business practices. If JustMarkets was a scam, it would not be regulated by reputable regulators.

Security

JustMarkets takes the security of client funds and data very seriously. They use industry-standard SSL encryption and two-factor authentication to protect accounts. Client funds are also held in segregated accounts at top banks, separate from the broker’s funds. These security measures exceed industry standards and help ensure your money and information are protected.

Trading conditions

JustMarkets offers tight spreads, fast execution speeds, and a wide range of tradable assets. They have won several industry awards for “Best Trading Conditions” and “Best Forex Broker”. Scam brokers are unable to match these high standards and trading conditions.

Funding and withdrawals

Deposits and withdrawals with JustMarkets are free, fast, and straightforward. They accept major payment methods like bank transfers, credit/debit cards, Skrill, and Neteller. Withdrawals are processed within 1 business day. Scam brokers make it very difficult to withdraw funds, often charging high fees or refusing withdrawals altogether.

Pros and Cons of JustMarkets

Pros of JustMarkets

- Regulated and secure. JustMarkets is regulated by top-tier financial authorities like the FCA and ASIC. Your funds and data will be secure.

- Low fees. JustMarkets charges no commissions on stock, ETF, and options trades. There are no monthly or annual account fees either. The low costs allow you to keep more of your money.

- User-friendly platforms. The web platform and mobile apps are intuitive and easy to navigate. Even beginners can start trading quickly.

- Excellent education. JustMarkets provides useful trading education for all skill levels. You’ll have access to video courses, webinars, tutorials, and more to improve your knowledge.

Cons of JustMarkets

- Higher than average spreads. The spreads on some of JustMarkets’ products tend to be a bit higher than competitors. While the $0 commissions are nice, the spreads can add to your overall costs.

- Limited customer service. JustMarkets only provides customer service during market hours and on weekdays. If you need help outside of those hours, you may encounter some difficulties reaching them.

Final Thought

JustMarkets seems to check a lot of important boxes with competitive fees, a good range of assets, and strong regulation and security. The minimum deposit is low to get started and you have flexibility in how you fund and withdraw from your account.

While the selection of educational resources could be expanded, customer support is there when you need them. If you’re looking for an established broker to trade forex and CFDs, JustMarkets is worth serious consideration.